News

VAT API is Brexit Ready

Published: December 8, 2020

We were approached by the UK tax authority HMRC (Her Majesty’s Revenue & Customs) in May of 2018 to see if we would be interested in assisting them in the research and development phase of a new API to lookup UK VAT numbers. Post Brexit the EU Commision will remove the ability to validate UK VAT numbers via their VIES service. HMRC had a duty to provide an alternative so businesses across the world can continue to validate UK VAT numbers post Brexit.

As the Brexit deadline looms we are delighted to tell you our service now integrates with the HMRC’s new ‘Check a UK VAT number’ API behind the scenes, all UK VAT number validations are now performed against their API for both the vatapi.com and bulkvatvalidator.com services we run.

VAT API is the longest standing and original API for EU VAT, we take pride in staying ahead of the curve and providing a service that businesses globally can rely on, we look forward to working with new an old clients post Brexit. Although VAT API has focused historically on serving data for the 28 EU member states as we are a UK based business we feel it is important to support UK businesses post Brexit so we have decided to continue to include the UK in our data set.

What changes if any will this mean for existing customers?

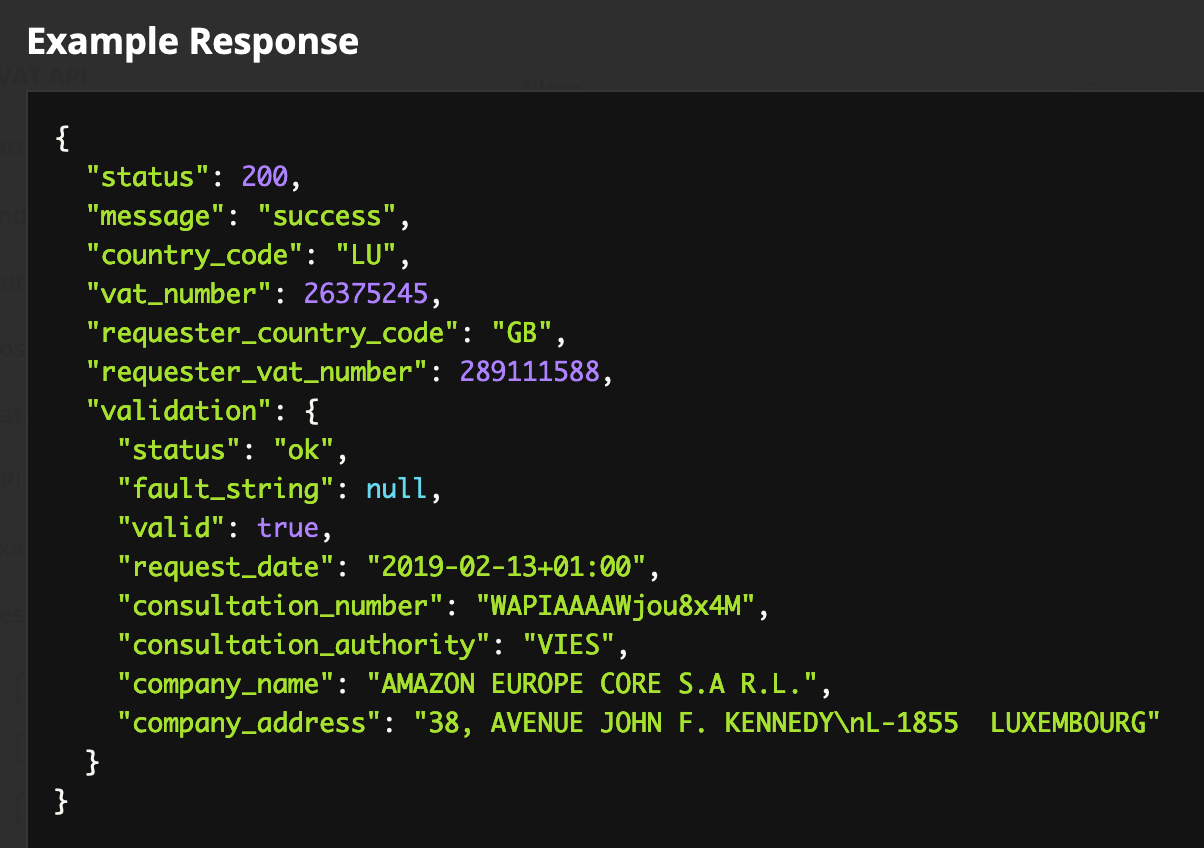

The changes made are seamless so all existing integrations will continue to function as normal. The only minor change is customers of Version 2 of the API will see an extra ‘consultation_authority’ field alongside the ‘consultation_number’ field in the VAT Number Validation resource response. This field simply identifies which authority the given vatid was checked against, for example UK VAT numbers will return the value HMRC and EU members state numbers return the value VIES.